Empower Your Green Goals

With a deep understanding of both fiscal and regulatory landscapes, MGO provides businesses, governments, and nonprofits with the strategic insights needed to capitalize on clean energy opportunities. Through our tailored approach, we can assist you to not only meet but exceed your green energy objectives.

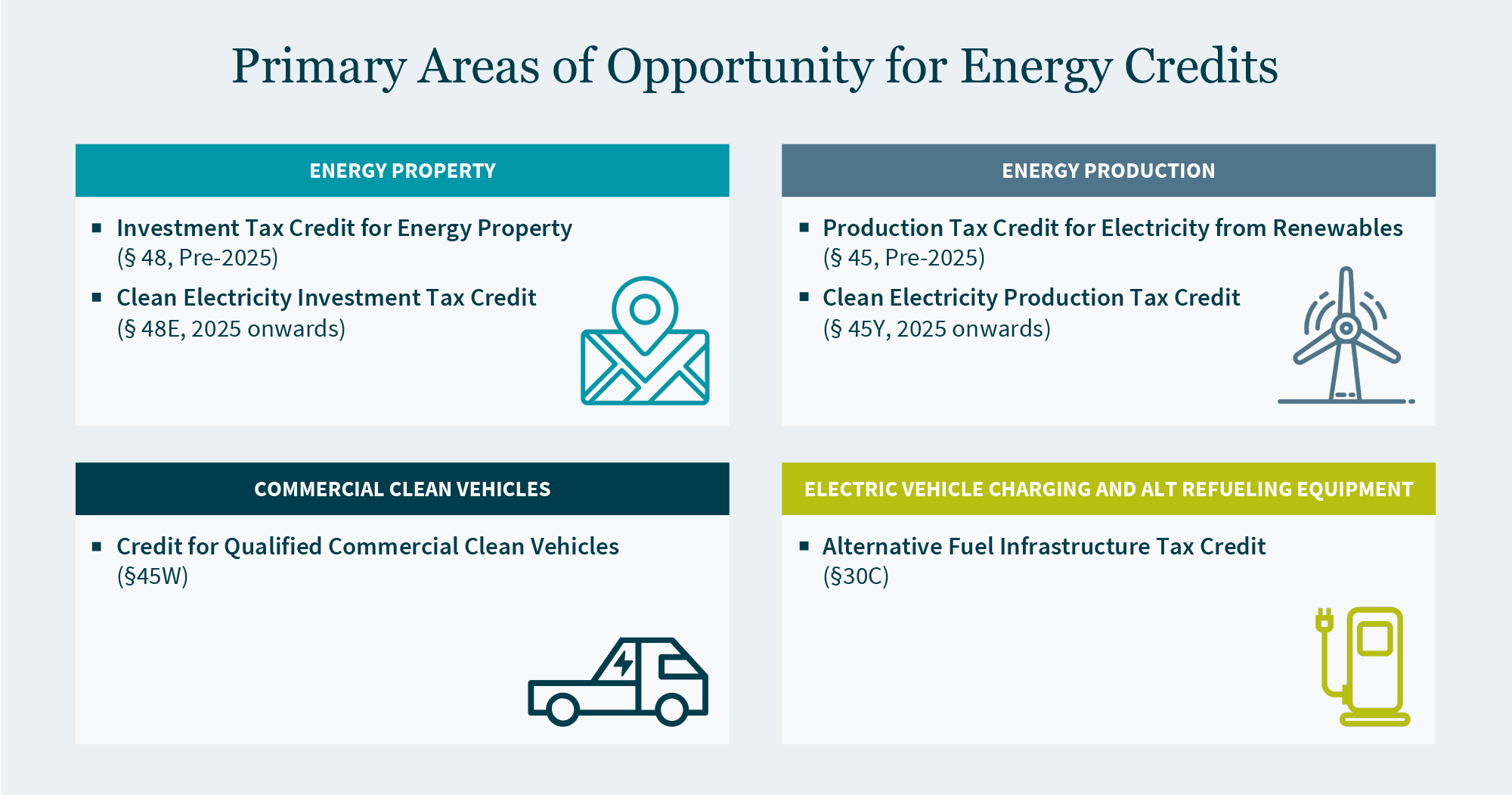

Available tax credits enable entities that have no federal income tax liabilities to benefit from clean energy incentives. Taking advantage of these credits can advance your sustainability goals and improve your financial efficiency.

Our team is ready to help you harness the power of renewable energy with strategic financial insights and comprehensive compliance support. Discover how elective pay can assist in making renewable energy projects more affordable and accessible.

How We Support Your Goals

Identifying Eligible Projects and Bonus Credit Programs Available

We help you identify and pursue renewable energy projects that qualify for elective pay — including solar, wind, geothermal, and other clean technologies — as well as Bonus Credit Programs to maximize return on investment that require a separate application process

Navigating Tax Requirements

Our team provides detailed guidance to help your government agency administer and oversee tax credit programs. We equip you with the necessary tools to manage IRS eligibility requirements for these programs, assisting with the implementation of additional incentives or bonus credits that benefit your constituents.

Pre-filing and Compliance

We have tools that can assist you in navigating the pre-filing registration process with the IRS, helping to handle all documentation and compliance checks seamlessly.

Filing and Maximizing Returns

We assist with the filing of necessary tax returns, including Form 990 or 990-T, Form 3800, and confirm your elective pay election is valid and maximized (if applicable).

Financing Consultations

Our advice includes how bridge or debt financing impacts your tax credit claims, including considerations for tax-exempt bonds.

Unlock Clean Energy Tax Credits for Your Government or Nonprofit

For the first time, state and local governments and nonprofits that do not owe federal income taxes will be able to receive funds through elective pay — equal to the full value of the tax credits — for qualifying clean energy projects and activities. Elective pay enables government entities that have no federal income tax liabilities to benefit from clean energy tax credits. Taking advantage of these credits can advance your government or nonprofit’s sustainability goals and improve your financial efficiency.

MGO can guide you through this process, helping you understand how to access these benefits and comply with IRS guidelines. Elective pay is only effective for taxable years beginning after December 31, 2022 (i.e., for tax years ending no earlier than December 31, 2023).

Our Perspective, Your Benefit

Leaders Ready to Serve You

As you grow, you face complex risks and opportunities. Benefit from hands-on guidance focused on delivering top-to-bottom value for you and your organization.

Related Solutions

Tax Credits and Incentives

Put your profits back where they belong: driving expansion and innovation for your organization. With experienced guidance credits and incentives can be a powerful tool for fueling your growth.

Government Audit

Provide effective stewardship powered by deep understanding of technical and regulatory nuances.

Related Industries

Tribal Nations and Gaming

At the crossroads of tradition and innovation, Tribal leaders must chart a course for their communities’ future. We’re here to help you avoid risk and capitalize on opportunity so you can enter a new era of growth.